UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive |

☐ |

|

| Soliciting Material under §240.14a‑12 |

NORTHWEST PIPE COMPANY

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | No fee |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

☐ | Fee paid previously with preliminary |

☐ |

|

|

| |

|

| |

|

| |

|

| |

201 NE Park Plaza Drive, Suite 100

Vancouver, WA 98684

April 12, 202115, 2024

Dear Fellow Shareholder:

You are cordially invited to attend the 20212024 Annual Meeting of Shareholders (“Annual(the “Annual Meeting”) on Thursday, June 10, 2021,13, 2024, at 7:00 a.m. Pacific Time. As part of ourNorthwest Pipe Company’s effort to encourage broader participation in the Annual Meeting, as well as maintain a safe and healthy environment for our directors, members of management, and shareholders in light of the coronavirus disease 2019 (“COVID‑19”) pandemic, the Board of Directors has determined that this year’sthe Annual Meeting will be conducted virtually via webcast instead of in-person. You will be able to attend the meeting, vote your shares, and submit questions by logging in at www.virtualshareholdermeeting.com/NWPX2021NWPX2024.

YOUR VOTE IS IMPORTANT. As a shareholder of Northwest Pipe Company, you can play an important role in our Company by considering and taking action on the matters set forth in the attached Proxy Statement. We appreciate theThe time and attention you invest in making thoughtful decisions.decisions is appreciated.

It has been a rewarding year, but not without its challenges. Thank you for your support and continued interest in Northwest Pipe Company.

Sincerely, | |

| |

Scott Montross President and Chief Executive Officer |

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

To the Shareholders of Northwest Pipe Company:

The 2021 Annual Meeting of Shareholders (the “Annual Meeting”) of Northwest Pipe Company (the “Company”) will be held via webcast on Thursday, June 10, 2021, at 7:00 a.m. Pacific Time. While there will be no physical location, shareholders may attend and participate in the Annual Meeting virtually by logging in at www.virtualshareholdermeeting.com/NWPX2021. To participate in the Annual Meeting, you will need your unique 16‑digit control number printed in the box and marked by the arrow on your proxy card or on the voting instructions from your stockbroker, bank, or other nominee that accompanied your proxy materials.

The purposes of the Annual Meeting will be:

| DATE | Thursday, June 13, 2024 |

| TIME | 7:00 a.m. Pacific Time |

| PLACE | VIRTUAL: www.virtualshareholdermeeting.com/NWPX2024 |

| RECORD DATE | Close of business on April 11, 2024 |

| MAILING DATE | This Proxy Statement, together with the enclosed proxy card and the Annual Report on Form 10‑K for the year ended December 31, 2023 (“2023 Annual Report to Shareholders”) of Northwest Pipe Company (collectively with its subsidiaries, the “Company”) are first being mailed to shareholders of the Company on or about April 25, 2024 |

1. | To elect three directors, each to serve for a three-year term; |

2. | To hold an advisory vote on the Company’s executive compensation; |

3. | To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the year ending December 31, |

|

|

Only shareholders of record at the close of business on April 9, 2021 are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting.

It is important that your shares be represented and voted at the meeting. Please complete, sign, and return your proxy card, or use the Internet or telephone voting systems.

We are enclosing a copy of the Company’s Annual Report on Form 10‑K for the year ended December 31, 2020 (“2020 Annual Report to Shareholders”) with this Notice and Proxy Statement.

| |

4. |

|

|

Vancouver, Washington

April 12, 2021

|

| ||

|

| |||

|

| ||

| |||

| |||

| ||

|

| ||

|

|

| ||

| |||

|

PROXY STATEMENT FOR THE

2021 ANNUAL MEETING OF SHAREHOLDERS OF

NORTHWEST PIPE COMPANY

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

NORTHWEST PIPE COMPANY

201NE Park Plaza Drive, Suite100

Vancouver, Washington 98684

360-397-6250

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE10, 2021

This Proxy Statement and the accompanying

At the Annual Meeting, shareholders will be asked to vote on the following matters:

|

|

|

|

|

|

|

|

This Proxy Statement, together with the enclosed proxy card and the 2020 Annual Report to Shareholders, are first being mailed to shareholders of the Company on or about April 23, 2021.

The Board of Directors has fixed the close of business on April 9, 2021 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were 9,857,9619,921,802 shares of Common Stock then outstanding, with each share of Common Stock being entitled to one vote.

If

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

Shareholders who execute proxies retain the right to revoke them at any time prior to the exercise

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

CREATING STAKEHOLDER VALUE

‘Creating Stakeholder Value' Section starts on page 6.

| 58 | Years of Quality Manufacturing Data as of 12/31/2023 | 13 | Manufacturing Facilities | 1,325 | Company Employees | 4 | Branded Product Lines | |||||||||

Founded in 1966, Northwest Pipe Company 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684, or by attendingis a leading manufacturer of water-related infrastructure products. In addition to being the Annual Meetinglargest manufacturer of engineered steel water pipeline systems in North America, the Company manufactures stormwater and voting electronically duringwastewater technology products; high-quality precast and reinforced concrete products; pump lift stations; steel casing pipe, bar-wrapped concrete cylinder pipe, and one of the virtual meeting. All valid, unrevoked proxies will be voted at the Annual Meeting.largest offerings of pipeline system joints, fittings, and specialized components.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| PROXY SUMMARY |

A combination of new population centers, rising demand on developed water sources, substantial underinvestment in water infrastructure over the past several decades, impacts from climate change, and increasingly stringent regulatory policies are driving demand for water infrastructure projects and environmental solutions across the United States.

The Company’s core market for its Engineered Steel Pressure Pipe (“SPP”) segment is the large-diameter, high-pressure portion of a water transmission pipeline, which the Company believes has a total addressable market of approximately $2 billion over the next three years.

With the Company’s goal of creating growth and profitability to drive shareholder value, Northwest Pipe Company continues to look beyond the engineered welded steel pipeline market and address the much larger potential market of concrete pipe and precast. The Company believes the water-related Precast Infrastructure and Engineered Systems (“Precast”) segment has a total annual addressable market of approximately $3 to $5 billion. The Company’s environmental solutions and engineered equipment manufactured by its Precast segment support this addressable market and provide precast infrastructure products that facilitate water efficiency, security, wastewater pretreatment, and stormwater quality.

The Company will continue to maximize its SPP segment by being opportunistic with the limited but identified potential acquisition opportunities, as well as expand its footprint in the precast concrete and engineered solutions market for growth through expansion or acquisition.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| PROXY SUMMARY |

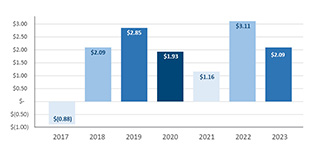

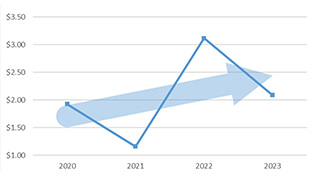

| EARNINGS PER SHARE | COMPOUND ANNUAL GROWTH RATE | |||

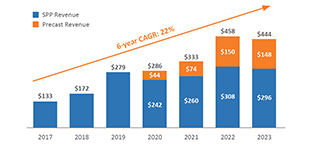

| Basic net income per share is computed by dividing the net income by the weighted-average number of shares of common stock outstanding during the period. Diluted net income per share is computed by giving effect to all potential shares of common stock, including restricted stock units (“RSUs”) and performance share awards (“PSAs”), assumed to be outstanding during the period using the treasury stock method. The chart below shows diluted net income per share from continuing operations, which was $2.09 in 2023. The Company’s SPP market has seen improved resiliency to variability in demand. The addition of the Precast segment has improved the Company’s margins and cash conversion cycle. | The compound annual growth rate (“CAGR”) is the mean annual growth rate of revenue over a specified period of time longer than one year. The chart below shows the Company’s revenue by segment (in millions) and its six-year compound annual growth rate of 22%. The Company has achieved its growth principally through acquisitions, acquiring Ameron Water Transmission Group, LLC, its largest SPP competitor in 2018, before strategically selecting the precast concrete market and completing the acquisitions of Geneva Pipe and Precast Company (“Geneva”) (2020) and Park Environmental Equipment, LLC (“ParkUSA”) (2021). | |||

|  |

CORPORATE GOVERNANCE

‘Corporate Governance’ Section starts on page 16.

OurCORPORATE GOVERNANCE HIGHLIGHTS

SHAREHOLDER EMPOWERMENTAND ENGAGEMENT | ✔ | 10% threshold for shareholder to call a special meeting |

| ✔ | Robust year-round shareholder engagement | |

| ✔ | No poison pill | |

| ✔ | Initiated share repurchase program of up to $30 million to enhance shareholder value by improving financial metrics | |

SKILLED AND INDEPENDENT “BOARD” | ✔ | All directors are independent, except the Chief Executive Officer (“CEO”) |

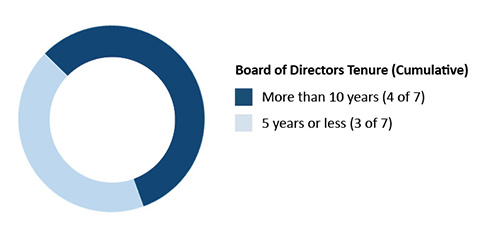

| ✔ | Range of tenures enables balance between historical experience and fresh perspectives | |

| ✔ | Skills and background aligned to the Company’s strategic direction | |

| ✔ | Director recruitment and selection process that prioritizes skills and qualifications and emphasizes leadership traits, work ethic, independence, business experience, and diversity of background | |

| ✔ | Training opportunities to address evolving business environment and governance landscape | |

| ✔ | Diverse experience (industry, profession, public service, geography) |

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| PROXY SUMMARY |

DEFINED BOARD STRUCTURE AND PROCESSES | ✔ | Annual self-assessment to enable adequate Board refreshment and appropriate evaluation of Board skills, experience, and perspectives; results shared and discussed in executive session of independent directors |

| ✔ | Annual review of Corporate Bylaws and Corporate Governance Principles to ensure alignment with best practices | |

| ✔ | All committee members are independent directors | |

| ✔ | All members empowered to call special Board meetings at any time for any reason | |

| ✔ | Regular executive sessions of independent directors | |

ROBUST OVERSIGHT OF RISKS AND OPPORTUNITIES | ✔ | Board responsible for risk oversight, with specific risk areas delegated to relevant Board committees |

| ✔ | Purposeful inclusion of key risk areas on Board and/or committee agendas | |

| ✔ | Engagement with business leaders to review short-term plans, long-term strategies, and associated risks | |

| ✔ | Incentive compensation not overly leveraged and with maximum payout caps and design features intended to balance pay for performance with the appropriate level of risk-taking | |

| ✔ | Robust stock ownership requirements and prohibition from hedging and pledging Company securities | |

| ✔ | Incentive compensation clawbacks in the event of a financial restatement | |

COMMITMENT TO SUSTAINABILITY AND CORPORATE RESPONSIBILITY | ✔ | Dedicated adherence to principles of Integrity and Ethics, Diversity, Equity and Inclusion, and Workplace Respect |

| ✔ | Fostering core values, particularly safety, while balancing a performance culture based on Company behaviors | |

| ✔ | No use of corporate funds for political contributions; robust oversight of and transparency into political activities |

PROPOSAL #1: ELECTION OF DIRECTORS

‘Proposal #1: Election of Directors' Section starts on page 24.

Nominees | Title | Years of Service | Independent | Committee Membership |

| Amanda Julian | Senior Partner of NeoPsy Systems | 4 | Yes | Environmental and Social Governance Committee - chairperson; Nominating and Governance Committee |

Keith Larson | Retired Vice President of Intel Corporation | 17 | Yes | Audit Committee - chairperson; Compensation Committee; Environmental and Social Governance Committee |

| Richard Roman | Retired Chief Executive Officer of Northwest Pipe Company | 21 | Yes | Audit Committee |

| YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

The Board of Directors unanimously recommends that shareholders vote “FOR” the election of its nominees for director. Proxies solicited by the Board will be voted “FOR” the election of the Board’s nominees unless a vote withholding authority is specifically indicated.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| PROXY SUMMARY |

PROPOSAL #2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

‘Proposal #2: Advisory Vote on Executive Compensation' Section starts on page 33.

EXECUTIVE COMPENSATION

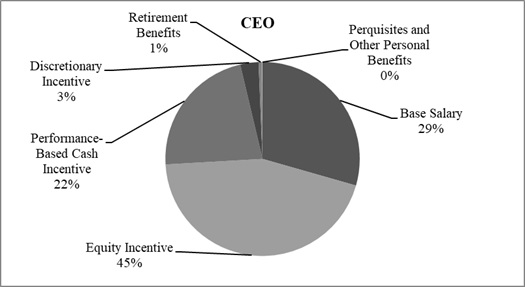

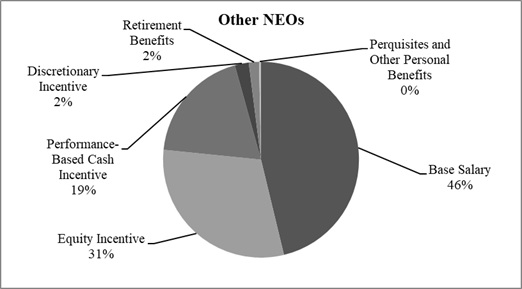

The following table reflects compensation awarded to the Company’s CEO, Chief Financial Officer (“CFO”), and each of the three other most highly compensated executive officers (collectively the “Named Executive Officers” or “NEOs”) in 2023. More detailed information regarding Executive Compensation can be found on page 33 under “Executive Compensation Discussion and Analysis” and on page 41 under “Summary Compensation.”

Name | Principal Position | Salary | Stock Awards | Non-Equity Incentive Plan Compensation | All Other Compensation | Total | |||||||||||||||

Scott Montross | Director, CEO, and President | $ | 700,793 | $ | 977,844 | $ | 720,939 | $ | 14,748 | $ | 2,414,324 | ||||||||||

Aaron Wilkins | Senior Vice President, CFO, and Corporate Secretary | 391,250 | 365,012 | 241,499 | 12,270 | 1,010,031 | |||||||||||||||

Miles Brittain | Executive Vice President | 391,250 | 365,012 | 241,499 | 16,536 | 1,014,297 | |||||||||||||||

Eric Stokes | Senior Vice President, SPP | 342,285 | 327,539 | 176,063 | 14,009 | 859,896 | |||||||||||||||

Michael Wray | Senior Vice President, Precast | 338,575 | 312,709 | 174,154 | 14,958 | 840,396 | |||||||||||||||

| YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

The Board of Directors unanimously recommends voting “FOR” the approval of the compensation of the NEOs as disclosed in this proxy statement and as described pursuant to the compensation disclosure rules of the Exchange Act.

‘Proposal #3: Ratification of the Appointment of Moss Adams LLP' Section starts on page 51.

Audit fees include fees for the audit of the annual financial statements, including required quarterly reviews, the audit of the Company’s internal control over financial reporting, and services in connection with other regulatory filings. Fees for services billed by the Company’s principal accountant, Moss Adams LLP (“Moss Adams”), for the years ended December 31, 2023 and 2022 were as follows:

2023 $1,472,000

2022 $1,388,000

| YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

ADDITIONAL INFORMATION

‘Additional Information' Section starts on page 52.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

CREATING STAKEHOLDER VALUE

Northwest Pipe Company’s core values are Accountability, Commitment, and Teamwork, or ACT for short, which it seeks to demonstrate in all of its behaviors and daily interactions, both internally and externally, and with all of its stakeholders.

PROFESSIONAL STANDARDS

Northwest Pipe Company takes pride in the high standards of conduct that it identifies with as a Company. The Company has controls in place relating to compliance with its Code of Business Conduct and Ethics (“Code”), including a requirement for employees and the Board of Directors to review and understand the requirements of the Code, as well as an established whistleblower hotline and related procedures. The Company conducts training on the Code in regular intervals during the employee’s life cycle; the next training will be held in the fourth quarter of 2024. The Company also conducts anti-trust training annually. The most recent anti-trust training for certain senior management and sales employees was conducted in the first quarter of 2023.

In 2023, the Company overcame macroeconomic headwinds to continue to realize strong financial performance. Despite interest rate pressures and a relatively small bidding market for the Company’s Engineered Steel Pressure Pipe segment, revenues in 2023 remained elevated compared to historical standards. Additionally, the Company successfully remediated the previously identified internal control material weakness over the implementation of its enterprise resource planning system for the acquisition of ParkUSA, and began a transition to material resource planning system automation at the ParkUSA facilities. The Company enters 2024 with a strong backlog and order book, and expects 2024 steel pressure pipe demand (tons) to increase approximately 40 percent compared to 2023.

| REVENUE GROWTH (IN MILLIONS) | PROFITABILITY | |||

| In 2023, net sales revenue decreased 3% to approximately $444 million from approximately $458 million in 2022. Despite the recent decrease, the six-year revenue CAGR is 22%, fueled by completing three significant acquisitions over that timespan. The Company aims to continue its transformation and drive shareholder value through organic growth and future acquisitions. | The Company’s diluted net income per share in 2023 was $2.09 and is still strong in relation to the $3.11 diluted net income per share in 2022, when the precast market was at record levels. | |||

|  |

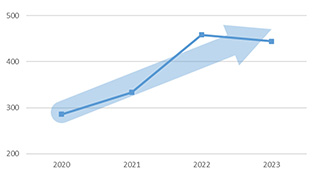

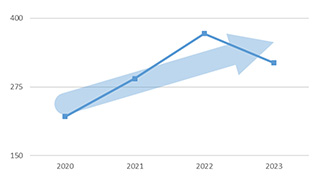

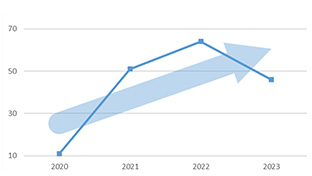

SPP BACKLOG INCLUDING CONFIRMED ORDERS (IN MILLIONS) | PRECAST ORDER BOOK (IN MILLIONS) | |||

As of December 31, 2023, the Company had a backlog(1) of $273 million. The Company evaluates demand for its SPP segment using backlog including confirmed orders(2), as confirmed orders are generally not canceled and, as such, provides a more holistic measure of demand. As of December 31, 2023, SPP’s backlog including confirmed orders was $319 million, indicating a healthy project load and future revenue. | As of December 31, 2023, the Company had an order book totaling $46 million in the Precast segment, a 29% decrease from the prior year record levels. Even though challenged by macroeconomic headwinds, the Precast order book is considered strong since it is a shorter lead time business. ‘Order book’ includes unfulfilled orders outstanding at the measurement date. | |||

|  |

| (1) | ‘Backlog’ includes the balance of remaining obligations under signed contracts for which revenue is recognized over time. | ||

| (2) | ‘Confirmed orders’ includes projects for which the Company has been notified that it is the successful bidder, but a binding agreement has not been executed. |

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CREATING STAKEHOLDER VALUE |

GROWTH AND STRATEGIC OPPORTUNITIES

Northwest Pipe Company’s growth strategy continues to focus on diversifying into a broader water market and capitalizing on the unique attributes of its market position, production capabilities, reputation, and nationwide sales and distribution footprint. The Company’s goal is to create transformational growth and profitability to drive shareholder value via an organic growth “Product Spread” strategy and through acquisitions.

Strategic acquisitions present prime opportunities for the Company to further expand its reach in the precast-related market. The Company acquired Geneva in January 2020, a concrete pipe and precast concrete products manufacturer based in Utah. This acquisition expanded the Company’s water infrastructure product capabilities by adding additional reinforced concrete pipe (“RCP”) capacity and a full line of precast concrete products including storm drains, manholes, catch basins, vaults, and curb inlets as well as innovative lined products that extend the life of concrete pipe and manholes for sewer applications. In October 2021, the Company acquired ParkUSA, a technology leader in water infrastructure products that manufactures water, wastewater, and environmental solutions at its three operating facilities in Texas. The ParkUSA products are assembled within concrete vaults or steel fabricated housings that can be delivered direct to the job site, saving valuable installation time for the Company’s customers.

Given the size of the addressable precast market, the Company aspires to grow organically by increasing and spreading the manufacturing of ParkUSA’s products to pre-existing Northwest Pipe Company facilities:

| • | Build out capacity utilization at ParkUSA facilities in Texas | ||

| – | Booked approximately $9 million in ParkUSA orders outside of Texas in 2023, a 42% increase from the prior year | ||

| • | Expand production of ParkUSA products at the Company’s other Precast facilities | ||

| – | 17 ParkUSA projects have been produced in Utah, and four more are in production as of December 31, 2023 | ||

| • | Pursue market development where the Company has SPP production facilities, which provides a low cost of entry | ||

| – | Initial focus on wastewater, stormwater, and water distribution products | ||

| • | Emphasize cross-training across facilities | ||

Further, the Company is solidifying its commitment to the precast market by continuing to invest in its Geneva facilities in Utah. The Company has recently invested in a new batch plant at the St. George, Utah facility, replaced a concrete mixer and controls in the Salt Lake City, Utah facility, and has ordered a RCP machine with associated concrete batching and mixing equipment, also at the Salt Lake City facility. The RCP machine is expected to cost approximately $16 million and will improve efficiency and increase capacity to meet growing market demand for RCP as well as increase production capacity for other concrete products in Utah.

Future strategic acquisitions will target:

| • | Continuing to seek accretive acquisition candidates in the precast-related space | ||

| • | Evaluating prospective high-quality opportunities with the following key attributes: | ||

| – | Strong organic growth potential; | ||

| – | Strong margin characteristics; | ||

| – | Solid asset efficiency; | ||

| – | Positive cash flow profile; | ||

| – | Accretive to earnings; | ||

| – | Industry and geographic location alignment with strategic growth plan; | ||

| – | Performance indicators based on revenue and earnings before interest, income taxes, depreciation, and amortization (“EBITDA”) thresholds; | ||

| – | Strong brand reputation and relationships in industry; and | ||

| – | Experienced management teams. | ||

In addition to the focus placed on the Company’s growth strategy, the following strategic and operational initiatives also play a critical role in the business:

| • | Maintain a safe workplace where employees are proud to work; | |

| • | Improve performance through a persistent focus on margin over volume; | |

| • | Continue to implement cost reductions and efficiencies at all levels of the Company; | |

| • | Identify strategic opportunities to grow the Company through expansion or acquisitions; and | |

| • | Return value to stockholders through opportunistic share repurchases in the absence of acquisition opportunities. |

Northwest Pipe Company’s performance culture enables it to be agile in response to the fast-changing needs of its customers and is supported by its three core ACT principles: Accountability, Commitment, and Teamwork. In addition to these key components, core drivers of the manufacturing operations include safety, quality, innovation, “Lean Manufacturing,” and reducing environmental impact through all areas of the business. This unwavering commitment underlies the principle that good business, economic growth, and social responsibility flourish together.

2023 ESG efforts largely focused on the Company defining its ESG vision and assessing current business operations to identify where ESG principles are already in practice (e.g. employee health/safety, waste reduction, recycling). High-level ESG objectives and the path forward were established under the supervision of the Board of Directors through exercises with the Company’s senior management. Other specific ESG efforts included:

| • | ESG Foundation/Baseline: Consisted of a series of benchmarking exercises to establish the Company’s current “ESG identity” and gauge the collective appetite for how intensive the program should be moving forward. This first step also accounted for industry standards/trends and peers’ behaviors in the ESG realm. The benchmarking assessment provided a practical starting point, highlighting strengths to build on, as well as opportunities to advance ESG priorities. | ||

| • | ESG Vision Establishment: The Company published a statement communicating its ESG commitment on its website, with emphasis on: | ||

| – | Creating a safe and engaging workplace environment where employees feel valued and supported in such a manner that enables them to succeed and grow; | ||

| – | Focusing on cultivating workforce diversity that is representative of the communities in which the Company operates, from the shop floor through the highest levels of the Company. In addition, through the Company’s organizational efforts and practices, striving to ensure that its employee groups are culturally and socially accepted, welcomed, and equally treated in the workplace; and | ||

| – | Prioritizing continuous improvement in reducing the Company’s impact on the environment. | ||

| • | Materiality Assessment: Conducted in March 2023, this three-day workshop featured a series of interviews with a multidisciplinary group of subject matter experts and department heads. The overall goals of the exercise were to identify ESG risks and opportunities, provide data to serve as a tool to further assist in defining overarching strategy, and convey ESG and sustainability reporting and communications content to stakeholders. Discussions highlighted stakeholder priorities such as: Employee Safety and Occupational Health; Business Model Resilience; Diversity, Equity, and Inclusion; Human Capital Development; Greenhouse Gas (GHG) Emissions; and Economic Performance. | ||

| • | Greenhouse Gas (GHG) Emissions Scope 1 and 2 Inventory: As part of its commitment to sustainability, in May 2023, the Company conducted its first ever Scope 1 (direct emissions from sources controlled by the Company) and Scope 2 (indirect emissions from the purchase of electricity, steam, heat, or cooling) inventory, in partnership with an independent sustainability consultant. This effort was performed to establish a baseline against which future progress and emissions reduction efforts are measured. The analysis focused on both direct and indirect emissions produced from the Company’s manufacturing practices in the year ended December 31, 2022, broken down by each facility. | ||

| A second inventory based on 2023 emissions is planned to be conducted in the second quarter of 2024 and will be again validated by an independent sustainability consultant. The Company will use this data to analyze year-over-year performance and establish consistency in its emissions inventory management and will consider appropriate next steps in late 2024. | |||

The Company is reviewing the recently finalized climate disclosure rules from the Securities and Exchange Commission (“SEC”) as it plans the collection and disclosure of information to assure compliance. Importantly, the Company understands that the information collected, accumulated, analyzed, and disclosed under this rule will require appropriate internal controls. The Company’s early ESG efforts, primarily the Scope 1 and 2 Emissions Inventory, reflect its commitment to developing the necessary processes and reporting mechanisms to meet future disclosure requirements. In addition, the Company intends to begin a process of assessing climate-related risks and implementing risk mitigation practices at each of its facilities in mid-2024. Information from these efforts will be disclosed in accordance with the SEC’s final disclosure ruling.

Operationalizing and Integrating ESG

For 2024, the Company will continue its focus on operationalizing ESG into existing business practices and long-term strategic objectives. Since ESG principles are considered vital to the long-term business success, the Company will emphasize the following areas: (i) the ways in which ESG related initiatives create value for the Company; (ii) how the Company responds to evolving regulatory reporting requirements; (iii) customer needs and expectations; and (iv) non-financial/technical risk management. Some additional ongoing efforts to operationalize ESG include routinely analyzing the Company’s ESG ratings through a subscription to the Institutional Shareholder Services (ISS) business intelligence software, updating/publishing policies and procedures that contain ESG-related subjects, and marrying ESG to existing practices such as “Lean Manufacturing” (reduced waste, elimination of inefficiencies). As part of the practical application of tying ESG to existing practices, each facility will develop a tailored plan based on their unique needs and capabilities, focused on recognizing waste in production processes and identifying opportunities for improvement and innovation. This effort will be led by the Corporate Social Responsibility Manager (CSRM), who will make site visits to facilities and work in conjunction with appropriate facility personnel and a third-party sustainability consulting group.

Environmental Product Declarations

Environmental Product Declarations (“EPDs”) are now mandated in several locales where the Company manages active construction projects, and most prominently in the Western United States. In collaboration with third-party sustainability consultants, the Company recently embarked on a pilot project focused on developing EPDs for steel pipe products manufactured at its California facilities. The project will consist of a Life Cycle Assessment that will determine products’ global warming potential and identify the major contributors to the total environmental impact from the “cradle-to-gate” production process. Upon completion of the pilot project, the Company intends to replicate the EPD development process and will explore developing its own third-party verified “EPD-generation” tool that can be used during the bidding process for future projects. In addition to mandates and disclosure requirements, EPDs provide an opportunity for the Company to be more transparent about its products and practices, boost its brand image, improve supply chain management, and appeal to a broader customer base.

Water Security

As a manufacturer of water-related infrastructure products, the Company is committed to providing water to communities with the intent of improving environmental and public health outcomes. With climate change disrupting weather patterns and causing long-term drought in regions where water has previously been more available, responsible resource management and reliable water transmission solutions are becoming even more crucial. The Company’s quality and long-lasting engineered steel pipe products support critical modernization projects that replace or rehabilitate crumbling, aging infrastructure, reducing water loss and saving millions of gallons of water a year. Some examples of the projects the Company is proud to be involved with include:

• | The Yadkin Regional Water Supply Project in the growing region of northwest North Carolina will provide communities a long-term, sustainable water supply through the construction of a new water intake and pump station, a water supply pipeline, a water treatment plan, and a drinking water pipeline. Prior to this project, the area had not had a local source of natural water and instead had to rely on lakes and rivers in surrounding counties to supply water for its communities. | |

| • | The Lower Bois d’Arc Raw Water Pipeline Project in north Texas is the first major reservoir built in Texas in over thirty years. The formation of this reservoir also includes the construction of a dam and water treatment plant. This new infrastructure is capable of moving 236 million gallons of water daily, and directly addresses the need for increased water access in this area that has seen significant population growth in the last five years. | |

| • | The Navajo-Gallup Water Supply Project in northwest New Mexico will provide a sustainable water supply for approximately 250,000 people by conveying water from the San Juan River to the eastern section of the Navajo Nation, the southwestern portion of the Jicarilla Apache Nation, and the City of Gallup, New Mexico. |

PRIORITIZING HEALTH AND SAFETY

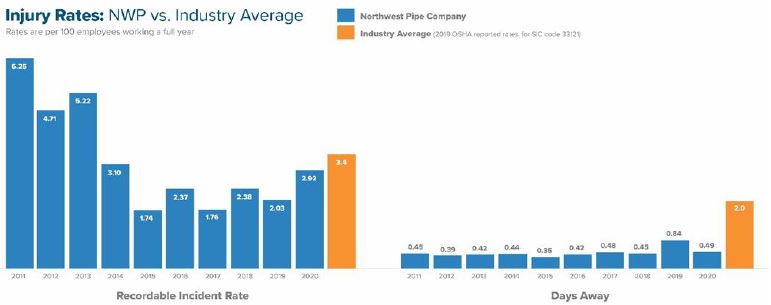

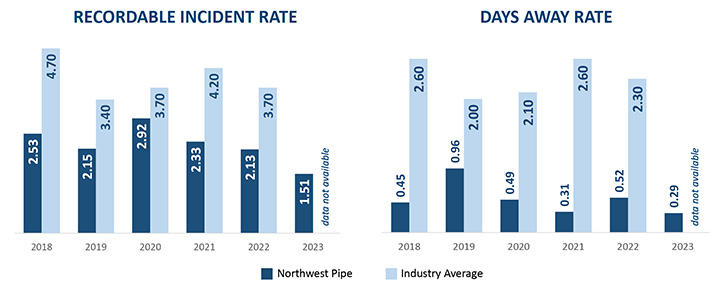

Northwest Pipe Company’s goal is to send each employee home safely at the end of the day. As such, safety is at the central core of the Company’s culture and is infused at every level of its organization. More than just policy and procedure, the Company’s safety program gives equal focus to the human side of safety, integrating coaching and mentoring efforts with compliance-driven approaches. By instilling a deep commitment to safety that reaches from the Company’s CEO to its general laborers, the Company has achieved industry-leading safety performance. Over the last four years, the Company’s average total recordable incident rate was 2.17 and its average days away rate was 0.39, calculated in accordance with the Occupational Safety and Health Administration’s (“OSHA”) record keeping requirements.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CREATING STAKEHOLDER VALUE |

To align the Company’s commitment to safety with its incentive compensation plans, in 2023 the executive officers and certain members of the senior management team who have direct responsibility for the Company’s safety program had 10% of their short-term incentive plan tied to the Company’s recordable incident rate, with a target of 2.8. The 2023 recordable incident rate of 1.51 was a Company record and is indicative of the importance it places on safety. In addition, two of 13 facilities exceeded one million work hours without a lost time incident, and nine of 13 exceeded one year since their last lost time incident.

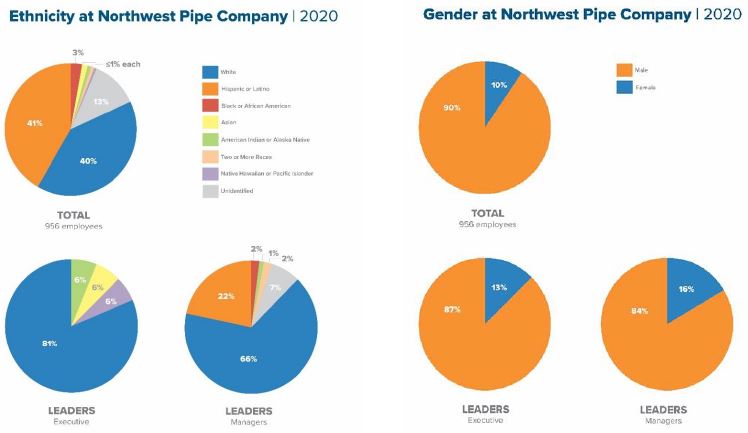

DIVERSITY AND INCLUSION

Northwest Pipe Company welcomes and embraces differences in age, gender identity, race, sexual orientation, physical or mental ability, ethnicity, socio-economic status, veteran status, or any other characteristics that make employees unique. The Company values these differences as strengths and believes its resilience and achievements as a company culminate from each individual’s background, perspective, and skillset.

The Company’s Affirmative Action Program (“AAP”) strives to hire, recruit, train, and promote employees without regard to race, age, religion, color, sex, national origin, physical or mental disability, marital or veteran status, sexual orientation, gender identity, or any other classification protected by law. Northwest Pipe Company only hires employees who meet the necessary education, training, skills and/or experience requirements to perform their job, and who can provide the required documentation pertaining to legal eligibility and age requirements. To support these efforts, the AAP for the Company’s facilities in the United States is reviewed annually by a third-party consultant, establishing annual hiring goals for women, minorities, veterans, and individuals with disabilities that are reflective of the communities in which the Company’s facilities are located.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CREATING STAKEHOLDER VALUE |

Increasing Women Representation

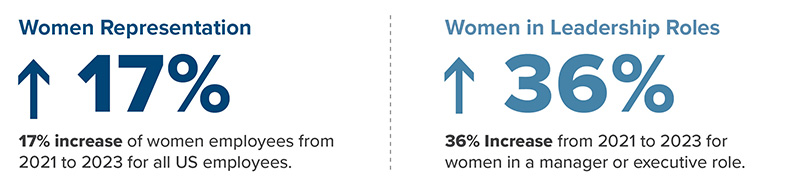

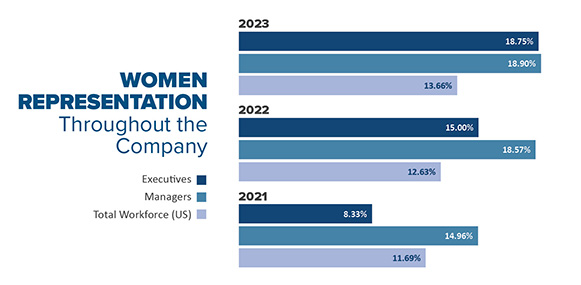

Northwest Pipe Company continues to support women representation at every stage of their career and at every employee base throughout the Company, from the production floor, to an engineering desk, and to a management office. In the past three years, representation of women at all levels increased 17% throughout the Company’s U.S. operation from 11.7% in 2021 to 13.7% in 2023. The Company also saw an increase of 36% of women representation in mid-level managers and senior executive roles, from 13.9% in 2021 to 18.9% in 2023.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CREATING STAKEHOLDER VALUE |

Race and Ethnicity Diversity

Northwest Pipe Company’s goal is to build a strong, skilled, diverse team. The Company’s promise is to provide an inclusive workplace where everyone, from any background, can do their best work. In the past three years, the Company has seen a steady increase in U.S. racial and ethnic minority representation.

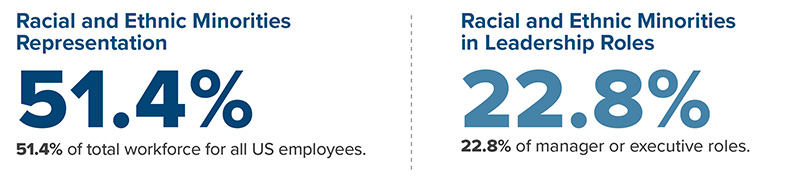

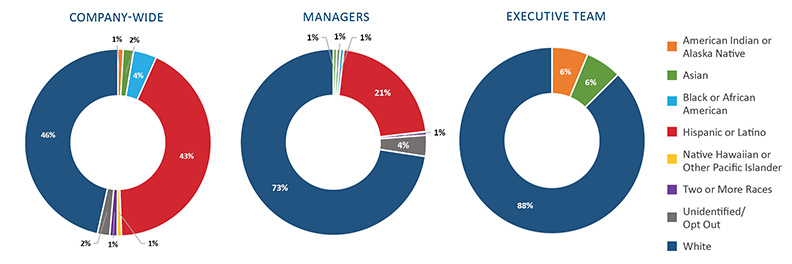

In 2023, 51.4% of the Company’s total U.S. workforce is comprised of racial and ethnic minority representation, and signifies a 12% increase from 45.9% in 2021. Racial and ethnic minorities representation of mid-level managers and senior executive roles continues to grow, from 21.9% in 2021 to 22.8% in 2023.

At Northwest Pipe Company, investment in employee development is not just an investment in individual employees, it is an investment in the Company’s long-term success and competitiveness. In addition to the Company’s continued focus on general skill development of its employees, the Company has sharpened its focus on the development of its leadership pipeline with the creation of the ACTivate program. ACTivate included three new initiatives in 2023: a broad leadership development program held in-person at locations across the Company, a small-group program focused on pairing a handful of promising employees with members of the senior executive team for one-on-one career coaching and mentoring, and identifying individual career and growth development opportunities for key employees.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CREATING STAKEHOLDER VALUE |

Northwest Pipe Company believes its employees are its biggest asset. Celebrating its workforce through its employee recognition efforts allows the Company to shine a spotlight on both individual and team achievements and acknowledge the hard work that contributes to the Company’s success.

Benchmark and Apex Awards: Each year Northwest Pipe Company selects one steel pressure pipe facility to receive the Benchmark Award, and one precast facility to receive the Apex Award. These awards are given to the facilities with the best overall performance as measured by achievements in safety, lean progress, process improvement participation, productivity, quality, revenue growth, and profitability.

Service Awards: Northwest Pipe Company is proud of the commitment of its employees to their ongoing service. 46% of the Company’s workforce boasts five years or more of service, bringing a depth of experience, skills, and knowledge. The Company recognizes the continued service of all its employees on each of their work anniversary dates and provides service awards in milestone service years beginning at their fifth year of employment.

Employee Spotlight: To honor and celebrate the Company’s diverse workforce, the Company has developed an employee spotlight program that interviews employees and asks them to share their thoughts related either to diversity recognition months or their career journey. Through these interviews the Company celebrates individual team members and delves into their experiences, challenges, and accomplishments and why they choose to build their career with Northwest Pipe Company.

Peer Recognition: impACT, the Company’s peer-to-peer recognition program, allows coworkers to nominate those who have gone above and beyond while displaying one of the ACT values of Accountability, Commitment, and Teamwork. Nominees are recognized on the Company’s internal employee recognition web platform where they can be celebrated by all employees.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE

Northwest Pipe Company’s Board of Directors and management have committed themselves to establishing a strong corporate governance environment and to adopting best practices to meet the needs and goals of the Company. As part of that commitment, we havethe Company has adopted Corporate Governance Principles, which cover such topics as qualifications and independence of Board members, the selection, orientation, and continuing education of Board members, as well as other topics designed to promote effective governance by the Board of Directors. We haveBoard. The Company has also adopted a Code of Business Conduct and Ethics, which applies to all employees, officers, and directors of the Company andCompany. It sets forth guidance to help in recognizing and dealing with ethical issues, to provide mechanisms for reporting unethical conduct, and to promote a culture of honesty and accountability, and a Code of Ethics for Senior Financial Officers, which applies to our senior financial officers and sets forth guidance to deter wrongdoing, promote honest and ethical conduct, and promote a culture of integrity and fairness. Copies of ourthe Corporate Governance Principles, Code of Business Conduct and Ethics, and Code of Ethics for Senior Financial Officers are available on the Company’s website at www.nwpipe.com under “Investor Relations”“Investors” — “Corporate Governance”,Governance,” or by writing to the Company’s Corporate Secretary, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684.

We haveThe Company has also adopted a Policy for Reporting Financial Irregularities (“Whistleblower Policy”), which is intended to create a workplace environment that encourages the highest standards of ethical, moral, and legal business conduct. The Whistleblower Policy establishes procedures for any person to confidentially and anonymously report violations, by us or any of ourthe Company’s personnel, of ourthe Code of Business Conduct and Ethics or any laws, rules, or regulations without fear of retaliation. The Whistleblower Policy also contains procedures for submission of complaints involving ourthe Company’s accounting practices and financial internal accounting controls.

Director ElectionsDIRECTOR ELECTIONS

While directors are elected by a plurality of votes cast, ourthe Company’s Corporate Governance Principles include a director resignation policy, requiring a director who receives morea greater number of votes “withheld” from his or her election than in favor ofvotes “for” such election in an uncontested election to tender an offer of their resignationshall submit to the Board of Directors a letter of resignation for consideration.consideration by the Nominating and Governance Committee. The Nominating and Governance Committee shall recommend to the Board of Directors the action to be taken with respect to such offer of resignation. The Board shall act promptly with respect to each such letter of resignation and the Board of Directors shall promptly determine whether to accept such resignation, and shall publicly disclose its decision and rationale.rationale within 90 days following certification of the shareholder vote.

Director IndependenceDIRECTOR INDEPENDENCE

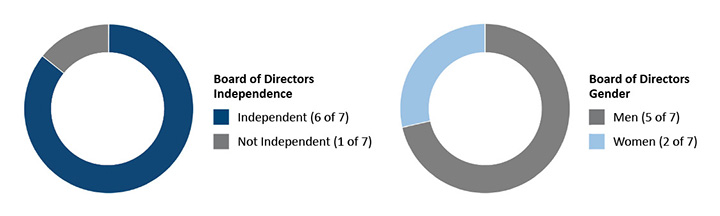

The current Board of Directors consists of seven directors, one of whom is currently employed by the Company (Mr. Montross). Mr. Roman, Chairperson of the Board, was employed by the Company until September 30, 2018. The Board of Directors has affirmatively determined that all of the other directors (Ms. Kulesa(Mss. Julian and Lockridge and Messrs. Franson, Larson, Paschal, and Yearsley)Roman) are “independent” in accordance with the standards of the Nasdaq Stock Market, including standards related to independence for service on the committees on which they serve, and as defined by the director independence guidelines included in ourthe Company’s Corporate Governance Principles.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

Criteria for Director Independence

For a director to be considered independent, the director must not have any material relationships with Northwest Pipe Company, either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company, other than as a director or shareholder. Material relationships can include vendor, supplier, consulting, legal, banking, accounting, charitable, and family relationships, among others. The Board of Directors considered all relevant facts and circumstances in making its determination of independence, including the following:

✔ | An independent director or nominee may not have been employed by Northwest Pipe Company or any of its subsidiaries or affiliates at any time during the past three years. | |

| ✔ | An independent director or nominee may not accept, or have a family member that accepts, any compensation from Northwest Pipe Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than (i) compensation for board or board member service, (ii) compensation paid to a family member who is an employee (other than an executive officer) of the Company, or (iii) benefits under tax-qualified retirement plan or non-discretionary compensation. | |

| ✔ | An independent director or nominee may not have a family member who is, or at any time during the past three years was, employed by Northwest Pipe Company as an executive officer. | |

| ✔ | An independent director or nominee may not be, or have a family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which Northwest Pipe Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than payments arising solely from the investments in the Company’s securities or payments under non-discretionary charitable contribution matching programs. | |

| ✔ | An independent director or nominee may not be, or have a family member who is, an executive officer of another entity where an executive officer of Northwest Pipe Company serves, or has served during the past three years, on the compensation committee of such entity. | |

| ✔ | An independent director or nominee may not be, or have a family member who is, a current partner of Northwest Pipe Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years. |

Board Leadership Structure and Risk OversightBOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

The Company’s Corporate Governance Principles provide that the independent members of the Board of Directors will select a lead director from among the independent directors if the positions of Chairperson of the Board and Chief Executive Officer (“CEO”)CEO are held by the same person, or if the Chairperson of the Board is not an independent director.director, or if the Board otherwise determines that a lead director is appropriate. The responsibilities of the Chairperson of the Board include the following: set Board meeting agendas in collaboration with the CEO; preside at Board meetings and the annual shareholders’shareholders meeting; assign tasks to the appropriate committees in accordance with their respective charters;committees; serve as an ex-officio member of each Board committee; and ensure that information flows openly between the management and the Board of Directors.Board. The responsibilities of the lead director include the following: coordinate the activities of the independent directors; make recommendations to the CEO in setting Board meeting agendas on matters concerning the independent directors; prepare the agenda for executive sessions of the independent directors, chair those sessions, and be primarily responsible for communications between the independent directors and the CEO. Mr. Roman,CEO; evaluate, along with the members of the Compensation Committee, the performance of the CEO; assist the Nominating and Governance Committee in the annual self-evaluation of the Board; recommend to the Chairperson of ourthe Board the retention of Directors, isconsultants, as necessary or appropriate, who report directly to the Board; advise the Chairperson of the Board as to the quality, quantity, and timeliness of information sent to the Board; consult with other members of the Board as to recommendations for Board and committee membership and chairpersons of the Board committees, and interview Board candidates; and perform such other duties as the Board may from time to time designate.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

Mr. Roman, who has served as the Chairperson of the Board since January 2013, was not “independent” within the meaning of the applicable rules of the Nasdaq Stock Market. Accordingly,Market until October 1, 2021 because of his previous employment with the Company. Mr. Franson remainswas appointed as the Board’s Lead Director since his appointment in August 2016.2016 while Mr. Roman was not considered “independent” within the meaning of the applicable rules of the Nasdaq Stock Market. Despite Mr. Roman now meeting the definition of “independent,” the Board has determined to retain Mr. Franson’s Lead Director designation, as a reflection of the Board’s commitment to principles of independence.

Board’s Role in Risk Oversight

The Board of Directors oversees management’s Company-wide risk management activities which include assessing and taking actions necessary to manage risks incurred in connection with the long-term strategic direction of the Company and the operation of ourits business. The Board of Directors uses its committees to assist in its risk oversight function.

While senior management has primary responsibility for managing risk, the Board of Directors has responsibility for risk oversight with specific risk areas delegated to relevant Board Committees who report on their deliberations to the Board. The specific risk areas of focus for the Board and each of its Committees are summarized below. The Board relies on senior management to keep it informed with respect to the nature of risks facing the Company and how the Company is managing those risks.

Board/Committee | Primary Areas of Risk Oversight | |

Full Board | ✔ | Safety and employee welfare |

✔ | Risk governance framework, including an enterprise-wide culture that supports appropriate risk awareness and the identification, escalation, and appropriate management of risk | |

| ✔ | Integrity, ethics, and compliance with its Code of Business Conduct | |

| ✔ | General strategic, commercial, operational, and economic risks | |

| ✔ | Financial projections including liquidity management | |

| ✔ | Strategic acquisition transactions, including execution and integration, and the competitive landscape for such acquisitions | |

✔ | Legal risks such as those arising from litigation, environmental, and intellectual property matters | |

| ✔ | Review of any other material transactions such as agreements involving corporate indebtedness, legal settlements or structure, commitments, or partnerships | |

Audit Committee | ✔ | Risk management practices, including data protection and cybersecurity |

| ✔ | Compliance with regulatory requirements | |

| ✔ | Ensure the mitigation of certain financial risks | |

| ✔ | Review the external auditor’s qualifications and independence | |

| ✔ | Treatment of any complaints regarding accounting, internal control, or auditing matters through the anonymous submission process, when applicable | |

| ✔ | Accounting compliance oversite including the Company’s integrity over financial internal controls systems and disclosures | |

| ✔ | Review of material findings of any examinations conducted by federal, state, or other agencies | |

| ✔ | Review of transactions with related persons | |

Compensation Committee | ✔ | Human capital management matters |

| ✔ | Compensation plans, programs, and arrangements and other employment practices and policies | |

| ✔ | Recruitment and retention of key talent | |

| ✔ | Labor compliance | |

| ✔ | Executive compensation | |

| ✔ | Maintaining remuneration framework |

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

| Board/Committee | Primary Areas of Risk Oversight | |

Environmental and Social Governance Committee | ✔ | Diversity and inclusion |

| ✔ | Environmental stewardship | |

| ✔ | Social responsibility and sustainability | |

| ✔ | Corporate philanthropic activities | |

Nominating and Governance Committee | ✔ | Identification of qualified candidates for membership on the Board of Directors |

| ✔ | Review of corporate governance developments for the purpose of recommending to the Board of Directors corporate governance practices, including revisions to the Company’s Corporate Governance Principles | |

| ✔ | Board training and onboarding | |

| ✔ | Recommending committee membership to the Company’s Board of Directors | |

| ✔ | Succession planning | |

| ✔ | Executive share ownership requirements and insider trading compliance |

Cyber-related Risks

The Board of Directors acknowledges the Company operates in a business environment encumbered by the increased risk of cyberattacks. The Audit Committee is responsible for oversight of our financial reporting process, financial internal controlsthe Company’s cybersecurity program and compliance activities,discusses the qualification, independence, and performance of our independent auditors, and compliance with applicable legal and regulatory compliance requirements.topic at least quarterly. The CompensationAudit Committee is responsible for oversightinvolved with the review of management’s risk associated with our compensation plans. The Nominatingassessment process and Governance Committee is responsible for oversightformulation of board processespolicies and corporate governance-related risk. The Board of Directors maintains overall responsibility for oversight of the work of its various committees by having regular reports from the chairperson of each Committee with respectprocedures to prevent, detect, and to the work performed by their respective Committee. In addition, discussions byextent it could become applicable in the Boardfuture, mitigate the effects of Directors abouta discovered breach. The Board’s expertise in risk assessment has been further enhanced with the Audit Committee chairperson earning a certification in cybersecurity risk, providing the Company with the appropriate oversight to this evolving threat. The Audit Committee believes that the Company’s strategic plan,efforts require continuous review due to the speed in which these types of criminal behaviors evolve, and due to the inherent risk with cybersecurity, that maintaining insurance is necessary to help protect the residual operational and financial results, capital structure, merger and acquisition related activity, and other business generally include discussion of the risks associated with the matters under consideration.involved which are not otherwise mitigated.

Board of Directors MeetingsBOARD OF DIRECTORS MEETINGS

Regular attendance at the Company’s Board of Directors meetings and the Annual Meeting is requiredexpected of each director. The Board of Directors held fivesix meetings during 2020,2023, in addition to adopting unanimous written consents in lieu of a meeting and soliciting informal Board consensus.meeting. Each of the directors attended more than 75% of the total number of Board and applicable Committee meetings during their tenure in 2020.2023. In addition, all of the directors serving at that time attended the Company’s 20202023 Annual Meeting of Shareholders.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

Board of Directors CommitteesBOARD OF DIRECTORS COMMITTEES

The Board of Directors has an Audit Committee, a Compensation Committee, an Environmental and Social Governance Committee, and a Nominating and Governance Committee. Each of the Committees consists of independent directors and each of the Committees has adopted a written charter which is available on the Company’s website at www.nwpipe.comunder “Investor Relations”“Investors” — “Corporate Governance,Governance.” or by writing to the Company’s Corporate Secretary, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684.

The table below lists the current membership of each Committee.

Board Member | Audit Committee | Compensation Committee | Environmental and Social Governance Committee | Nominating and Governance Committee | ||||

Michael Franson | ✔ | ✔ | + | |||||

Amanda Julian | ✔ | + | ✔ | |||||

Keith Larson | ✔ | + | ✔ | ✔ | ||||

| Irma Lockridge | ✔ | (1) | ✔ | (1) | ||||

John Paschal |

| (2) | ✔ | ✔ | + | |||

| Richard Roman | ✔ | |||||||

| Committee chairperson | ||||

(1) | Irma Lockridge was appointed to the Compensation Committee and the Nominating and Governance Committee in April 2023. | ||||

| |||||

| |||||

|

|

| |||

|

| ||||

|

|

| |||

John Paschal |

|

| |||

|

|

|

* Committee Chairperson

The Audit Committee of the Board of Directors is responsible for the oversight and monitoring of: the integrity of the Company’s financial reporting process, financial internal control systems, accounting legal, and regulatorylegal compliance, and the integrity of the financial reporting; the qualifications, independence, and performance of ourthe independent auditors; the Company’s compliance with applicable legal and regulatory requirements; oversight of risk management practices, including data protection and cybersecurity; and the maintenance of open and private, if necessary, communication among the independent auditors, management, legal counsel, and the Board of Directors.Board. The Audit Committee met eight times in 2020.2023. Each member of the Audit Committee is “independent” as defined by applicable SEC and Nasdaq Stock Market rules. The Board of Directors has determined that Messrs. Franson, Larson, and Yearsley qualifyeach member of the Audit Committee qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

The Compensation Committee of the Board of Directors is responsible for the oversight and determination of executive compensation by reviewing, recommending, and approving salaries and other compensation of the Company’s executive officers, and administering the Company’s equity incentive and compensation plans, including reviewing, recommending, and approving equity incentive and compensation awards to executive officers. In addition, the Compensation Committee is responsible for recommending to the Board of Directors the level and form of compensation and benefits for directors,all nonemployee directors; administering the Company’s Incentive Compensation Recovery Policy; oversight of the Company’s human capital management matters; and reviewing, recommending, and taking action upon any other compensation practices or policies of the Company as the Board of Directors may request or the Committee may determine to be appropriate. The Compensation Committee has sole authority to retain and terminate a compensation consultant to assist in the evaluation of executive compensation. The Compensation Committee met four times in 2020,2023, in addition to adopting a unanimous written consentconsents in lieu of a meeting. Each member of the Compensation Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

Environmental and Social Governance Committee

The Environmental and Social Governance (ESG) Committee of the Board of Directors is responsible for providing oversight and support of the Company’s environmental, health, diversity, and safety compliance policies, programs, and initiatives, and its commitment to environmental, health, diversity, and safety, corporate social responsibility, social governance, sustainability, and other related public policy matters (collectively, “ESG Matters”) relevant to the Company. The ESG Committee monitors the Company’s general strategy relating to ESG Matters, the Company’s communication plans with employees, investors, and other stakeholders of the Company with respect to ESG Matters, the Company’s developments relating to, and improving its understanding of, ESG Matters, and the Company’s compliance with certain ESG Matter-related legal and regulatory requirements. The ESG Committee met four times in 2023. Each member of the ESG Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

Nominating and Governance Committee.

The Nominating and Governance Committee of the Board of Directors recommends to the Board of Directors corporate governance principles for the Company, identifies qualified candidates for membership on the Board of Directors, and proposes to the Board, of Directors for its approvaland proposes nominees for election as directors.election. The Nominating and Governance Committee met fourfive times in 2020.2023. Each member of the Nominating and Governance Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

Director Qualifications and Diversity

The Company’s Corporate Governance Principles specify that the criteria used by the Nominating and Governance Committee in the selection, review, and evaluation of possible candidates for vacancies on the Board of Directors should include factors relating to whether the candidate would meet the definition of “independent” as well as skills, occupation, and experience in the context of the needs of the Board of Directors. All candidates for election to the Board of Directors must be individuals of character, integrity, and honesty. The Company does not have a formal policy with respect to the consideration of diversity in identifying director candidates; however, the Nominating and Governance Committee Charter includes diversity as one of several criteria in recommending and reviewing a director nominee candidate. From time to time, the Nominating and Governance Committee has employed a third party to help identify or screen prospective directors, and may continue to do so at their discretion.

Communications with DirectorsCOMMUNICATIONS WITH DIRECTORS

Any shareholder who wants to communicate with members of the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board, of Directors, c/o Chairperson of the Board, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be submitted to the intended member(s) of the Board of Directors in a timely manner.

Nominations by Shareholders.Shareholders

In identifying qualified candidates for the Board of Directors, the Nominating and Governance Committee will consider recommendations by shareholders. Shareholder recommendations as to candidates for election to the Board of Directors may be submitted to the Company’s Corporate Secretary, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684. The Nominating and Governance Committee will evaluate potential nominees, including candidates recommended by shareholders, by reviewing qualifications, considering references, and reviewing and considering such other information as the members of the Nominating and Governance Committee deem relevant.

The Company’s Bylaws permit shareholders to make nominations for the election of directors, if such nominations are made pursuant to timely notice in writing to the Company’s Secretary. To be timely, in accordance with the Company’s Bylaws as amended effective December 14, 2023, notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than 6090 days nor more than 90120 days prior to the first anniversary of the preceding year’s annual meeting. If the date of the annual meeting provided that at leastof shareholders is more than 30 days prior to, or more than 60 days’days after, the first anniversary of the date of the preceding year’s annual meeting, to be timely, a shareholder’s notice ormust be received not earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of (i) the 90th day prior to such annual meeting and (ii) the 10th day following the day on which public disclosure of the date of the meeting is given orfirst made to shareholders. If less than 60 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholderCompany. Any nominations for the 2025 Annual Meeting of Shareholders must be received by the Company not later than March 15, 2025.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

Any nominations by shareholders must also comply with the closetiming, disclosure, procedural and other requirements as set forth in the Company’s Bylaws, as well as any other applicable requirements set forth in Exchange Act Rule 14a‑19, including that the nominating shareholder actually solicit holders of business on the tenth day following the date on which such noticeshares representing at least 67% of the datevoting power of the meeting was mailed or such public disclosure was made.shares entitled to vote in the Company’s election of directors. A shareholder’s notice of nomination must also set forth certain information specified in the Company’s Bylaws concerning each person the shareholder proposes to nominate for election and the nominating shareholder.shareholder, and the shareholder and its nominee must undertake to provide supplemental information, agreements and questionnaires, as described in greater details in the Company’s Bylaws. The Company’s Bylaws, as amended effective December 14, 2023, expanded and clarified these notice and information requirements, along with certain other procedural matters.

The Audit Committee reports to and acts on behalf of the Board of Directors and is comprised solely of directors who satisfy the independence, financial literacy, and other requirements set forth in the listing rules of the Nasdaq Stock Market and applicable securities laws. In addition, each member of the Audit Committee qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

The Audit Committee operates under a written charter, approved and adopted by the Board of Directors, which sets forth its duties and responsibilities. This charter, which is available in full on the Company’s website at www.nwpipe.com under “Investors” — “Corporate Governance”, is reviewed annually and updated, as appropriate, to address changes in regulatory requirements, authoritative guidance, evolving oversight practices, and investor feedback.

The Audit Committee’s primary duties and responsibilities are the oversight and monitoring of:

• | the integrity of the Company’s financial reporting process, financial internal control systems, accounting and legal compliance, and the integrity of the financial reporting of the Company; | |

• | the qualifications, independence, and performance of the Company’s independent auditors; | |

• | the compliance by the Company with applicable legal and regulatory requirements; | |

• | oversight of risk management practices, including the Company’s data protection practices and cybersecurity program; and | |

• | the maintenance of an open and private, if necessary, communication among the independent auditors, management, legal counsel, and the Board of Directors. |

Management is responsible for preparing the Company’s financial statements and maintaining effective internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with applicable auditing standards and issuing a report thereon, and for performing an independent audit of the effectiveness of the Company’s internal controls over financial reporting. In this context, the Audit Committee performed the following:

• | met with Moss Adams, who has served as the Company’s independent registered public accountants since 2016, with and without management present, to review and discuss the Company’s audited financial statements and assessment of the Company’s internal control over financial reporting, as well as the critical audit matters addressed during the audit; | |

• | asked management and Moss Adams questions relating to such matters and discussed with Moss Adams the matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”), including Auditing Standard No. 1301, “Communications with Audit Committees”; | |

• | reviewed the terms of the audit engagement, the overall audit strategy, timing of the audit, and significant risks identified; and | |

• | reviewed the critical accounting policies and practices applied by the Company in preparation of its financial statements, and critical accounting estimates and significant unusual transactions affecting the Company’s financial statements. |

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| CORPORATE GOVERNANCE |

Based on the reviews and discussions described in this report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10‑K for the year ended December 31, 2023 for filing with the SEC.

The Audit Committee’s responsibilities also include monitoring the qualifications, independence, and performance of the Company’s independent auditors. In reviewing the auditor’s performance, the Audit Committee considers the quality and efficiency of the services provided by the audit team and reviews and discusses the auditor’s most recent PCAOB inspection report and its system of quality control. The Committee also reviews and discusses proposed staffing levels and the selection of the lead engagement partner from the independent registered public accounting firm. Further, the Audit Committee recognizes the importance of maintaining the independence of the Company’s auditor, both in fact and in appearance. For 2023, the Audit Committee received and reviewed the written disclosures and letter provided by Moss Adams as required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and the Audit Committee discussed with the independent accountants that firm’s independence. The Audit Committee concurs with Moss Adams’ conclusion that they are independent from the Company and its management.

Respectfully submitted by the Audit Committee of the Board of Directors.

AUDIT COMMITTEE

Keith Larson, Chairperson

Michael Franson

Richard Roman

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| PROPOSAL #1: ELECTION OF DIRECTORS |

PROPOSAL #1: ELECTION OF DIRECTORS

(Proposal No.1)

| YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

At the Annual Meeting, three directors will be elected, each to serve for a three-year term. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election of the nominees named below. The Board of Directors believes that the nominees will stand for election and will serve if elected as a director. However, if anythe person nominated by the Board of Directors fails to stand for election or is unable to accept election, the proxies will be voted for the election of such other person as the Board of Directors may recommend.

The Company’s Articles of Incorporation and Bylaws provide that the Board of Directors shall be composed of not less than six and not more than nine directors. The size of the Board of Directors is currently fixed at seven directors. Under the Company’s Articles of Incorporation and Bylaws, the Company’s directors are divided into three classes, with each class to be as nearly equal in number as possible. The term of office of only one class of directors expires each year, and their successors are generally elected for terms of three years, and until their successors are elected and qualified. The term of a director elected by the Board to fill a vacancy expires at the next annual shareholders’ meeting. There is no cumulative voting for election of directors.

The Nominating and Governance Committee has responsibility for identifying director nominees who collectively have the complementary experience, qualifications, skills, and attributes to guide the Company and function effectively as a Board. The Nominating and Governance Committee believes that the nominees presented in this proxy have the key personal attributes that are important to an effective Board of Directors: integrity, candor, analytical skills, willingness to engage management and each other in a constructive and collaborative fashion, and ability and commitment to devote significant time and energy to serve on the Board and its committees. The Company considers the following specific experiences, qualifications, and skills to be critical in light of its strategic priorities, business objectives, operations, and structure.

| Notice and Proxy Statement | 2024 | Notice and Proxy Statement | 2024 |

| PROPOSAL #1: ELECTION OF DIRECTORS |

InformationDIRECTOR SKILLS AND QUALIFICATIONS

STRATEGIC SKILLS

Industries, End Markets, and Growth Areas. Experience in industries, end markets, and growth areas that the Company serves enables a better understanding of the issues facing these businesses.

Manufacturing Experience. Growing sales outside of the engineered steel pressure pipe water transmission market, particularly in the precast concrete and engineered solutions market, is one of the Company’s long-term growth strategies. Hence, exposure to manufacturing economies is an important qualification for Company directors.

Regulated Industries/Government Experience. The Company’s customers and project stakeholders are subject to a broad array of government regulations, and demand for products and services can be impacted by changes in law or regulation in areas such as safety, environmental, and energy efficiency. It is important to Nomineeshave directors with experience in government and Continuing Directorsregulated industries that provide insight and perspective in working constructively and proactively with governments and municipalities.

Innovation and Technology. The Company strives to lead the industry in water transmission and infrastructure innovation. Expertise in product development, testing, and introduction is critical to continuing new growth paths for the Company’s business.